- The RULEMATCH spot trading venue has begun trading BTC and ETH versus USD.

- Only banks and securities firms may become RULEMATCH participants.

- RULEMATCH is never a counterparty in trading on the venue.

- Integrated post-trade settlement significantly lowers costs for institutions, removing the need to pre-fund trades.

- RULEMATCH provides the market integrity, capital efficiency and ultra-low latency that financial institutions have been missing.

- The venue uses Nasdaq technology for pre-trade risk checks, trade matching and market surveillance.

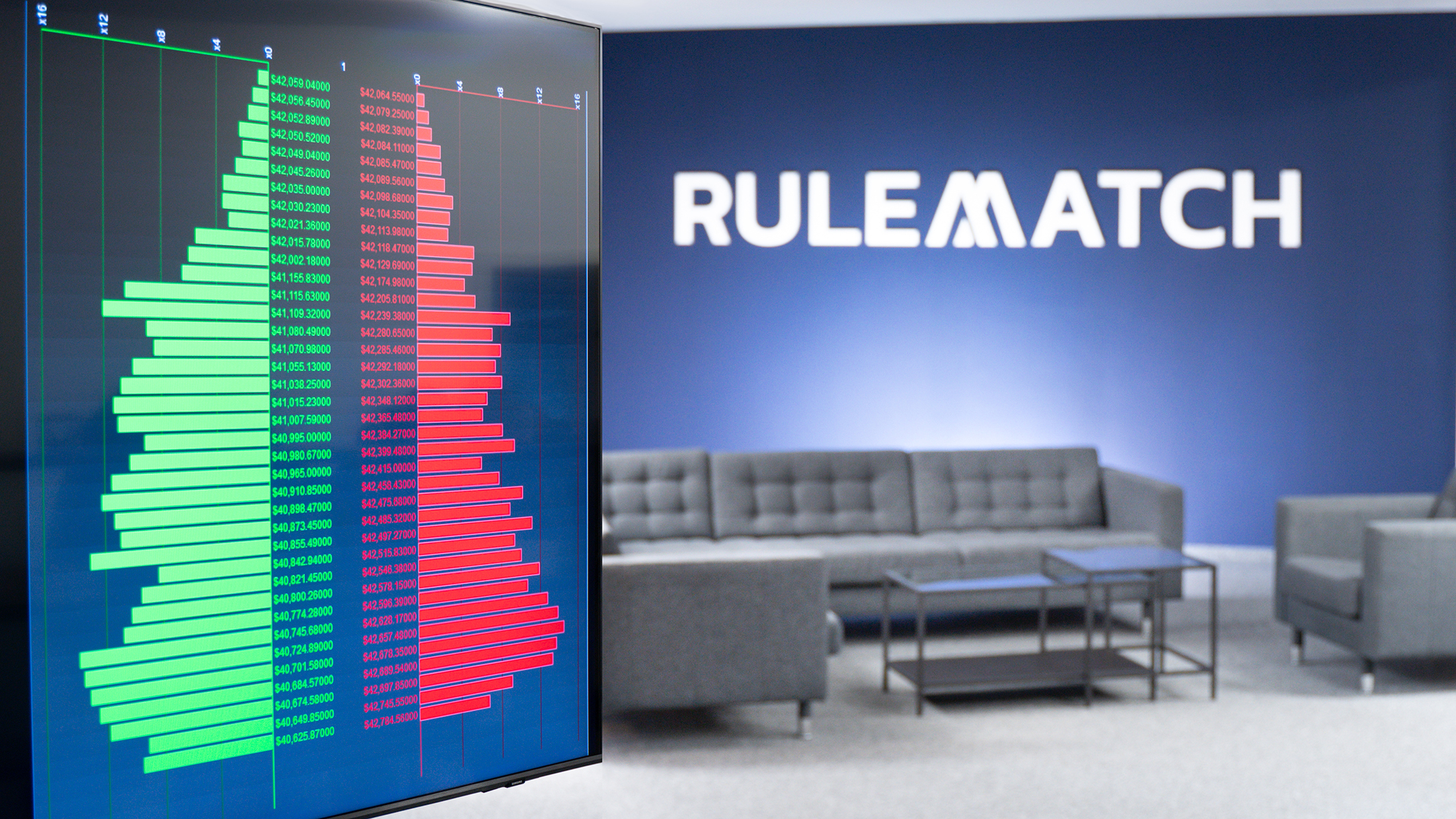

Zurich, Switzerland; 14 December 2023 – RULEMATCH has launched BTC and ETH spot trading against USD for its participants. It serves financial institutions, who have already been active in trading cryptocurrencies, allowing them to profit from execution and settlement capabilities not available in the otherwise retail-dominated market today. Only banks and securities firms from select countries may become RULEMATCH participants. Their benefits on RULEMATCH include trading on a central limit order book with execution times as low as 30 microseconds, as well as integrated post-trade settlement with multilateral clearing. This allows for trading with up to 75% less upfront liquidity required when compared to existing trading venues.

RULEMATCH currently counts seven banks and securities firms, including BBVA in Switzerland, a Swiss cantonal bank and DLT Finance as its initial participants. More financial institutions are in the process of joining the venue.

RULEMATCH CEO David Riegelnig commented: “Despite often going unnoticed, a growing number of banks and financial institutions have actually been quite active in the crypto market. But, as we all know, they have faced challenges due to the many fundamental deficiencies in existing market infrastructure – capital efficiency, counterparty risk, compliance and latency. On RULEMATCH, these banks and their institutional clients are now expanding their activities and deploying many of the same strategies that they have used in traditional markets. This bodes well for liquidity and development in the market – and also for the next wave of evolution in digital assets.”

RULEMATCH participants trade in an anonymous central-limit-order book with liquidity guaranteed by designated market makers including Flow Traders, who has entered into a strategic partnership with RULEMATCH to provide institutional-grade liquidity. Bankhaus Scheich Wertpapierspezialist with its tech arm tradias also serves as a designated market maker on RULEMATCH.

Michael Lie, Flow Traders Global Head of Digital Assets, commented: “As a strategic market participant, Flow Traders works together with platforms that enable the institutionalization of the digital asset market. Working with RULEMATCH aligns with this objective and by being there as day one market maker, we can provide the institutional grade liquidity desired by financial institutions to support the adoption of digital asset and contribute to improving the broader financial ecosystem. We are delighted to be working with RULEMATCH and expanding our partnership in the future.”

RULEMATCH leverages Nasdaq’s pre-trade risk, trading, and market surveillance technology to provide an additional layer of transparency and resilience for institutional participants, enabling them to trade on RULEMATCH at speeds unrivalled in the crypto market today. The matching engine is hosted in two data centers in the Zurich metro area where RULEMATCH participants and their clients may cross connect and collocate.

“We wish RULEMATCH every success as they look to grow their business and help drive greater institutional participation in the crypto market,” said Magnus Haglind, Senior Vice President and Head of Products, Marketplace Technology at Nasdaq. “Nasdaq’s modular and scalable platform helps venues of all sizes get to market efficiently and attract liquidity through efficient and transparent trading. As traditional and digital asset markets increasingly converge, our institutional grade technology is well positioned to support the ongoing development of the digital asset ecosystem.”

RULEMATCH acts exclusively as a market operator that brings together the buying/selling interests of counterparties to execute and settle transactions. It is never a counterparty to a trade and does not offer brokerage or market making services. RULEMATCH does not provide custody except for the settlement process, including collateral management.

RULEMATCH facilitates multilateral net settlement among participants, allowing them to trade in a highly capital-efficient manner. At the same time, counterparty risk among participants is addressed with a strict delivery-vs-payment process and collateral requirements to protect against counterparty default. This allows RULEMATCH participants to trade with up to 75% less up-front liquidity needed, compared to the practice of pre-financing and credit lines currently prevalent in the crypto market.

The combination of integrated, post-trade settlement and ultra-low latency open up new possibilities for institutional clients of RULEMATCH participants, such as hedge funds and high-frequency traders.

RULEMATCH has partnered with Luzerner Kantonalbank AG (LUKB), a AA-rated, state-guaranteed Swiss bank, to handle qualified participant fiat funds used as collateral and for settlement in fiduciary accounts.

All cryptocurrencies on RULEMATCH are handled in segregated blockchain wallets using the Metaco Harmonize system, the institutional standard in custody technology in combination with IBM Cloud Hyper Protect Crypto Services, the industry’s only encryption service based on a hardware security module certified to FIPS 140-2 Level 4. With encryption and confidential computing capabilities from IBM Cloud, RULEMATCH can ensure the security of participants’ assets at the highest level.

Participants and flow of participant funds are subject to stringent controls against money laundering, sanction evasion and terrorist financing. RULEMATCH utilizes Elliptic’s Holistic Lens and Navigator capabilities to screen each and every wallet and transaction as part of its trading and settlement operations for regulated financial institutions. It is also able to screen wallets and transactions for risk in real-time and at scale.

Reference prices on RULEMATCH draw on data from market-leading provider Kaiko to support the integrity of price discovery and market surveillance.

Participants can connect to RULEMATCH via a range of options including cross-connection at Equinix ZH4, AWS Direct Connect and collocation in Green Data Centers in the Zurich metro area. A number of multi-asset OEMS technology providers are connecting to RULEMATCH; Wyden and Axon Trade have already done so.

RULEMATCH is supported by a select group of Swiss and international investors including Consensys Mesh, a company of Ethereum co-founder Joseph Lubin, Flow Traders and FiveT Fintech, formerly known as Avaloq Ventures.

RULEMATCH’s headquarters and systems are located in Zurich, Switzerland, positioning it centrally in Europe. The country’s clear regulatory framework and legal certainty for digital assets provide an advantageous environment for RULEMATCH’s operations.

The information about RULEMATCH is for general informational purposes only and should not be considered exhaustive. They do not imply any elements of a contractual relationship nor any offering. The information contained herein is directed at banks and securities firms. Any person without professional experience in matters relating to investments should not rely on this information.

RULEMATCH contact:

Ian Simpson

Director of Marketing & Communications

ian.simpson@rulematch.com

About RULEMATCH

RULEMATCH is the premiere digital asset trading venue for financial institutions. It operates as a market operator for spot trading of BTC and ETH versus USD. RULEMATCH is never a counterparty in trading. Fiat funds are held in fiduciary accounts with a state-guaranteed, AA-rated Swiss bank and cryptocurrencies are handled on fully segregated wallets. With integrated multilateral clearing and post-trade settlement, as well as institutional-grade trading technology, RULEMATCH helps provide ultra-low latency, capital efficient trading and robust market integrity. Its offices and operations are located in Zurich – the heart of Europe. Its participant network is open to banks and securities firms only and limited to select countries. RULEMATCH is not available to US-based financial institutions.

The post Interbank Crypto Trading Venue Has Launched appeared first on RULEMATCH.